FinTech – Transforming the Future of Finance

Financial technology, or FinTech, is revolutionizing how we interact with money. By blending finance and innovation, FinTech is creating more inclusive, efficient, and customer-centric financial services. From digital wallets and mobile banking to robo-advisors and decentralized finance, FinTech is reshaping the financial landscape across the globe.

One of the most significant impacts of FinTech is financial inclusion. Millions of people who previously lacked access to traditional banking now use mobile apps to save, borrow, and transact. In developing countries, mobile money platforms like M-Pesa have become lifelines for individuals and small businesses.

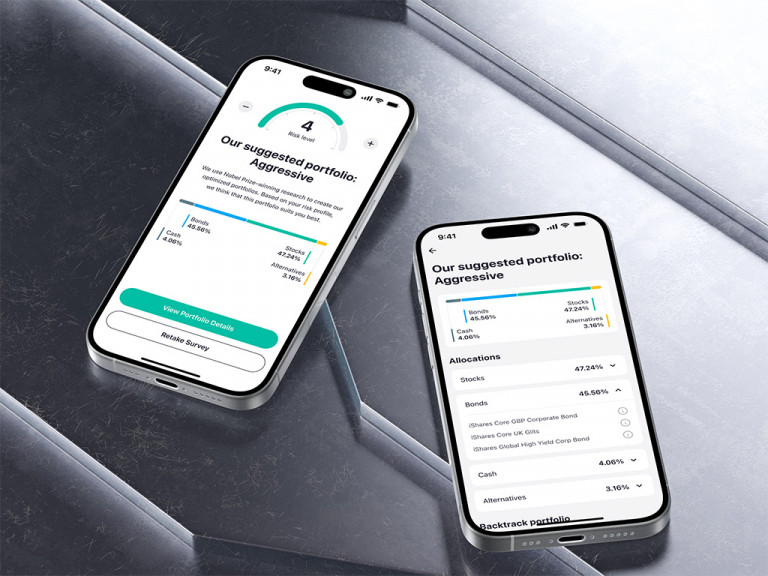

FinTech has also transformed how we manage investments. Robo-advisors use algorithms to offer personalized financial advice at a fraction of the cost of traditional wealth managers. Crowdfunding and peer-to-peer lending platforms provide alternative sources of capital for entrepreneurs and investors alike.

Blockchain and cryptocurrencies are redefining the concept of money. Decentralized finance (DeFi) enables users to engage in lending, trading, and savings without intermediaries. While still evolving, this space offers transparency, lower fees, and global access—though it also raises concerns about regulation and security.

Traditional banks are responding to the FinTech wave by embracing digital transformation. Many have launched their own apps, digital products, and partnerships with startups. Open banking—where financial institutions share customer data (with consent) via APIs—is paving the way for more personalized and competitive services.

Security and compliance are critical in FinTech. Companies are leveraging artificial intelligence and biometric authentication to enhance fraud detection and data protection. RegTech solutions automate compliance processes, reducing the cost and complexity of meeting regulatory requirements.

Despite rapid growth, FinTech faces hurdles such as cybersecurity threats, evolving regulations, and public trust. Responsible innovation, consumer education, and robust governance are essential to sustainable success.

As digital becomes the default, FinTech is no longer just a niche—it’s the future of finance.